Catherine Hammond, Principal Analyst, Analysys Mason, led a round table discussion at a recent NetEvents EMEA Press Spotlight titled: ‘Calling Winners And Losers As Operators Add More Services’. The discussion revolved around Value Added ICT Services for the enterprise market, how these could enhance telco profitabilty, the benefits for the enterprise and the change in mindset needed to embrace this opportunity.

Catherine Hammond covered “First a little bit on the revenue opportunity for operators of value-added services. Secondly, the importance of getting the basics right, basic customer care, basic good service on connectivity offerings, before you begin to add on value-added services. Then thirdly, some of the customer benefits of value-added services to the enterprise”.

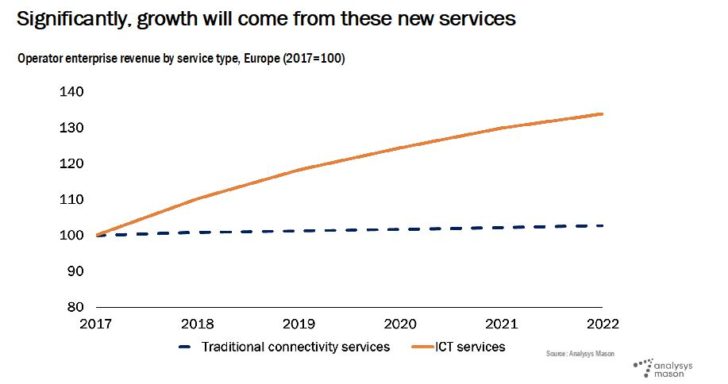

How important are Value Added ICT Services to the telcos? “This is taken from our market sizing model looking at Europe, and revenue to operators specifically from enterprises. This is not consumer revenue, not hardware revenue, not software licensing. …Last year, operators got around about €93 billion in total revenue from enterprises. Of that, some of the value-add IT services accounted for around €8 billion. So it’s a pretty small number. However, the crucial thing is, it’s growing.”

The graph compares revenue growth from traditional connectivity services (dashed line) and ICT services – both normalised to 100 in 2017. To explain the lack of growth in traditional services, she said: “As you can see that’s pretty much flatlining… Broadly speaking, what I see is demand growing for bandwidth, and that’s offsetting the price decline…. Enterprises are essentially getting more for the same money”.

She explained the difficulty in getting data from the telcos. There were some 30 operators who provide consistent data on enterprise as share of total revenue, and only ten that broke it down further to differentiate between enterprise revenue from traditional services and from IT services.

This diagram lists the ten operators included and shows that overall enterprise revenue (bottom bar) dropped by 0.6% – pretty much in line with other operators who supplied these figures. That total came from a drop of 3.4% in non-ICT services (eg data and voice revenue) and a gain of 6.7% in ICT services. “So, there’s a clear feed-through already into revenue from what operators are doing in this area. Some of it’s around acquisitions. Some of it’s around partnerships, building up their own capabilities.”

She then looked at growth in cloud services revenue, comparing some telcos with some tech giants. In growth terms the telcos are lagging, and yet 20% growth is nothing to be ashamed of. Surprisingly, AWS is down among the telcos, but remember, this is percentage growth. In actual numbers AWS made the biggest gain of all.

She suggested two opposite responses to these figures:

1 – AWS are hyperscalers, they’ve got it all sewn up. So no point in competing

2- This is such a massive market that it’s worth going even for a tiny bit of it.

Instead: “What we’re finding is that many operators are going down a third path. They’re building partnerships with AWS, with Azure, and they’re building partnerships to offer multi-cloud solution. They’re majoring on the connectivity. Then, they’re trying to offer more value-add services around that.”

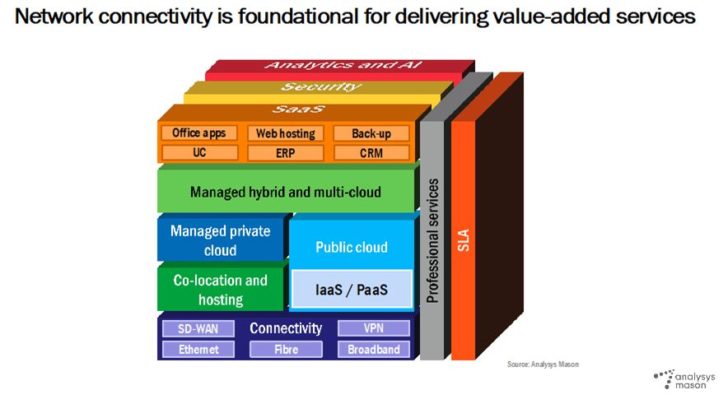

Her next diagram illustrated a potential set of value added services. “So, the bottom there, you’ve got various flavours of connectivity, and that would include cloud connectivity and WAN connectivity. Then, on top of that, you’ve got a whole pile of services around datacentres, cloud storage and compute, and then at the top you’ve got the apps layer. So, there’s some fairly generic apps, and some more specific ones… Running around all of these, we’ve got a set of service wraps which give the potential to create some higher-margin value-add services. So, we’ve got things around security, things around analytics and AI, and then running up beside, supporting all this, professional services, which I think are a really key enabler for many of the value-add services, and SLAs that fit around that.”

She pointed out that connectivity was the foundation, so that it had to be rock solid if you were to build on it: “I would argue the key components of any app value-add service offering is about getting the basic customer satisfaction right”.

She quoted the Net Promoter Score (NPS) which takes the percentage of customers who would actively recommend your service and subtracts those that would warn against it – to give a measure of customer satisfaction. Her company looked at enterprises that bought security services from their operator (NPS average 23), against those that went elsewhere (NPS average 2). “There seems to be a linkage between how satisfied businesses are with their operator, and how likely they are to buy value-add services.” She backed this with a graph from KPN, the only operator that publicly reports its NPS: “Again, it’s not meant to be cause and effect, but there seems to be some sort of correlation going on between their improved focus on customer care and customer satisfaction, and their beginning to turn around their revenue”.

Hammond concluded her introduction: “There’s all sorts of issues that enterprises face around trying to link up legacy and cloud services, dealing with security, dealing with regulatory compliance, different issues in different jurisdictions. I think service providers can have a real key role in bridging that complexity and managing it.”

The resulting discussion began around to what extent an enterprise benefits from procuring multiple networking value-add services from a single trusted service provider, and how can a service provider gain that trust?

Atchison Frazer, Versa Networks’ Worldwide Head of Marketing, said “There just aren’t enough people and enough resources, enough expertise, to manually manage that kind of complexity. It’s not uncommon for an operator to have under their management thousands of remote locations.” Philip Griffiths, NetFoundry’s Head of EMEA Partnerships, added: “Customers obviously want simplicity. They want their solution just to work. They don’t want to have to go through the manual process of building it out themselves”.

Atchison Frazer, Versa Networks’ Worldwide Head of Marketing

Verizon was quoted as a provider addressing the NPS issue – Greg Ferro from Packet Pushers pointed out just how unpopiular most telcos are with their customers. Hammond had spoken to Verizon recently: “one of the things they’ve been doing, they’ve introduced an integrated tool around sales and quote-contract process, and they’ve reported that they’ve reduced their cycle time by 50% by doing this – which is a key gain in terms of customer satisfaction”.

For Griffiths, the whole procurement and implementation process was critical: “The function of the net promoter score is to become a trusted advisor. Instead of them going through a procurement process where they issue RFIs and RFPs, and whittle down a list, instead they come to you and say, we’re developing this new capability. We really trust you, based upon what you did for us last time, what we’ve been doing for the last five years. Can you do it for us? That then gets you to a unique position where, as the network operator, you can provide those value-added services much more effectively to your end client”.

Philip Griffiths, NetFoundry’s Head of EMEA Partnerships

Ferro wondered to what extent enterprises were turning to SD-WAN because they “can’t wait to get away from telcos and move onto the internet and walk away from private MPLS services.” Speaking for NetFoundry, Griffiths responded: “It’s an interesting question, because that’s why we exist, to provide application connectivity over the public internet without the MPLS”. As for telcos: “They have spent too long being in this unique position of owning a market, of having something that someone needs and therefore not having to provide the best customer service. Fundamentally, if they want to continue to be relevant and not just be a utility with a low return on investment, they need to completely pivot their business towards looking at what the customer wants and investing much more on innovation”.

But do they have the capability? Griffiths continued: “You can build capability in many ways… You could acquire a local systems integrator. You could incubate an internal start-up in order to build capabilities outside the super tanker of the adult organisation in order to create those in-house capabilities. Fundamentally, they have to make a decision of where they strategically want to go, and then to start changing their culture, because I think it’s a question of culture, ultimately.”

Frazer also pointed out that, in the case of SD-WAN, the telco only has to sell the licence: “they don’t actually touch anything. It’s failproof”. That, according to Griffiths, was part of the problem, because telcos should really be aiming for “trusted advisor” status: to have sales people that actually talk to clients about their application and security needs, and not just about a core network. Then they can become relevant.

Frazer suggested: “If you really want to be a trusted advisor, you have to have better intelligence and better analysis of what’s going on in every single location. That’s where the telco or the operator has the opportunity to be the trusted advisor, provide professional services wrapped around that intelligence. Verizon are one of the leading managed security service providers – MSSP. They have a very robust annual threat intelligence report”.

For Griffiths: “At the end of the day the CEO doesn’t care about the network. He cares about the business… it’s always good to reduce costs, and to reduce risks, but if you’re trying to win business on reducing costs and reducing risk, then effectively you’re in Sales Mode A, where you’re just getting the RFP and you’re responding to it, and then you’re always competing and having to fight for market share. “Whereas if you’re focusing on where the business value is, then you’re able to become that trusted advisor in sales mode B, where you can build that long-term relationship”.

Hammond turned to Frazer, as someone who sells via service providers: “Is there anything that you can do to assist the operators in communicating the benefits? Are you doing that sort of thing already?” Frazer replied: “In our case everything’s automated through software. Any information that you could possibly want – that you never had before with the legacy architecture – you can derive from our analytics layer and our software architecture.” He went on: “My team, my marketing team, has done probably 25 roadshows with Verizon and their customer base”.

Turning to Griffiths, she raised the point that, in terms of value added services, telcos typically offered quite generic applications. “Do you think that value-add services should be sold as a generic service that you can apply to your business in different ways? Or, is there a case for focusing on specific vertical segments?”

Replying, Griffiths pointed out that, whereas it was tempting to go for a big market like supporting Office 365, a finance company probably uses it very differently from a healthcare company. “They have specific needs, and if you want to be relevant and help customers to achieve their business objectives, then it really comes down to understanding the vertical, the specific application instances that they use. It’s easy to say we can deliver application support, we can deliver cloud. It’s much more difficult to actually do it in specific areas with the challenges that customers have.”

Frazer agreed: even if it is one financial services company using Office 365, it makes a big difference how they are using it for corporate IT or for a customer facing network. “I used the example yesterday: the ATM network where you actually extract cash should be segmented from all other traffic… In our case, you can set up a policy and say ‘I want a premium QOS fast lane just for my Office 365, and I want a dedicated conduit that just delivers that traffic and it’s never congested by the other kind of traffic’. Focusing on the application, the end-user, the folks that are actually having to use those applications.”

Jeremy Cowan, from IoT now and Vanilla Plus, asked whether any other providers, like KPN were doing a better job with managed solutions. Hammond responded: “I think there’s a lot of opportunities for operators to do this. What I’m hearing at the moment is more around aspiration and thinking ‘we need to do this in order to be given bid opportunities to get in on the RFPs, or to migrate our existing customers’. But I think there’s still a lot of uncertainty about how best to go about that.”

For Griffiths: “It has to be in the area of making the services they provide to their clients as seamless as possible, for them to get more value from their IT. That sounds very broad and prosaic, but it turns into tactical conversations around, retraining their workforce to actually understand end-users’ requirements, needs, and architecture – and not just the network. It means investing in the software overlay so they can deliver a more AWS or Azure experience – where they can just click and deploy, rather than having to wait for four months for a truck to turn up. It means looking more at the vertical areas of their actual end applications and what they’re trying to achieve, rather than just delivering a product and throwing it over the fence.”

Frazer agreed: “If they can think more like the innovative technology companies that they serve, and actually start investing in things that are going to help them create a new dynamic with the enterprise. That’s where they should be investing.”

In summing up these comments, and the whole session, Catherine Hammond said: “They [telcos] don’t need to be at the cutting edge of the latest, greatest technology. What they need to be able to do is to deliver to enterprises something that works, something that’s reasonably up there, and yes, like we talked about security yesterday, how much security do you need to do? You need to do enough. How much innovation do you need to have? Well, enough to satisfy the needs of most enterprises.”

By Lionel Snell, NetEvents

Imagen principal: Catherine Hammond, Principal Analyst, Analysys Mason.